Beginning January 1, 2024, many companies in the United States will have to report information about the people who own and control the business as well as the applicant (the individual who filed the application to form their company) to the federal government. The information must be reported to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

This new reporting rule was established by the Corporate Transparency Act (CTA) passed in 2021 to combat shell companies set up for money laundering, financing of terrorism, fraudulent purposes, and other illicit practices.

In September 2022, the Treasury Department finalized regulations to implement the Corporate Transparency Act and set an effective date of January 1, 2024.

What Is Required by the Corporate Transparency Act?

The Corporate Transparency Act requires “reporting companies” to report certain identifying information about their owners and the individual who filed the application to form the entity (called an “applicant”). The applicant could be you or the attorney or legal service you may have engaged to help form your company.

The report need only be made one time, unless there is a change in ownership or the company’s exemption status, as defined by the Act. Your company must file an updated report no later than 30 days after the date on which the change occurred.

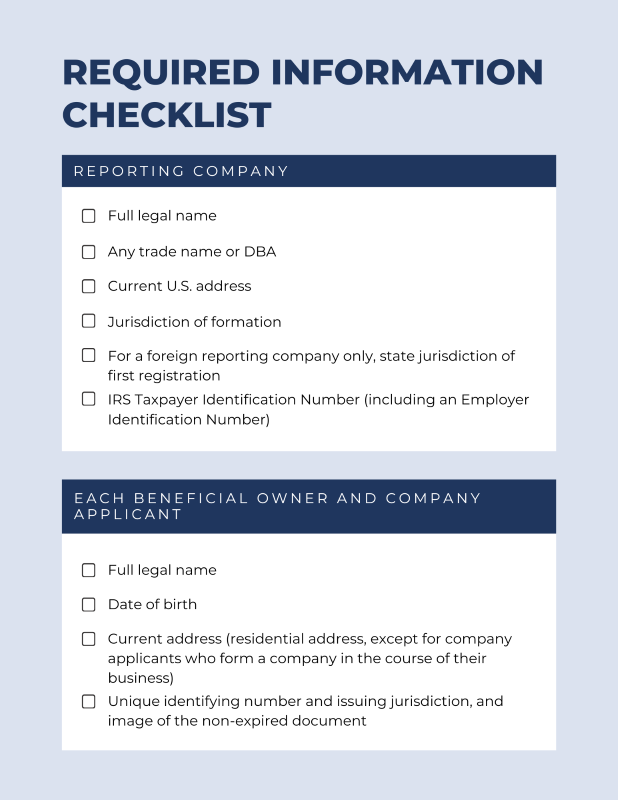

Your business may be required to collect and report the following information:

Given the sensitivity of the data collected, FinCEN is only authorized to disclose reported information to a defined group of governmental authorities and financial institutions. Federal agencies, for example, may only obtain access to the company information for national security, intelligence, or law enforcement activities. State and local law enforcement agencies must get authorization from “a court of competent jurisdiction” to request access to the reported information.

What Is a “Beneficial Owner”?

As defined by the Corporate Transparency Act, a beneficial owner is an individual who:

- Exercises substantial control over the entity (such as a senior officer or other important decision maker); or

- Owns or controls 25 percent of the ownership interests of the entity.

FinCEN published a Small Entity Compliance Guide to help small businesses comply with the beneficial ownership information reporting rule.

What Is a Company Applicant?

The company applicant is the individual who directly files or registers an application to form or register an entity (usually with your state’s Secretary of State) and the individual primarily responsible for directing or controlling the filing or registration. The applicant could be you or the attorney you may have engaged to help form your company.

All company applicants must be individuals. Companies or legal entities cannot be company applicants.

Not all reporting companies are required to report their company applicants to FinCEN. Companies created or registered before the effective date of the regulation, January 1, 2024, do not need to report information about their company applicants.

Is My Business Required to Report to FinCEN?

Any corporation, limited liability company, or other similar entity created by the filing of a document with the Secretary of State, or formed under the laws of a foreign country and registered to do business in the United States, is required to report beneficial owner information to FinCEN, unless exempted.

Effectively, this means that almost all domestic entities will be required to report ownership information to FinCEN, unless they fall into one of 23 excepted categories. Generally, these exempted entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

Do I Have to File for Exemption?

No, if your company falls within the 23 exempt entities, you are not required to file a report or to register as an exempt entity.

The 23 exempt entities are:

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity (Note: Homeowner Associations/HOAs may not be included in this exemption)

- Entity assisting a tax-exempt entity

- Large operating company

- Subsidiary of certain exempt entities

- Inactive entity

FinCEN’s Small Entity Compliance Guide (see chapter 1.2) includes the criteria for each exemption in a check-box format to help you answer the question, “Is my company exempt from the reporting requirements?”

The most common exemption may be the large operating company exemption. To qualify, your entity must meet all of the following criteria:

- Employ more than 20 full-time employees in the United States;

- Have a physical office within the United States; and

- Have filed a federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales (excluding gross receipts or sales from sources outside of the United States).

Your attorney can help advise you if your entity qualifies for this or any other exemption.

When Should My Company File Its BOI Report?

It depends on when your company was formed:

- If your company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025.

- If your company is created or registered to do business in the United States on or after January 1, 2024, and before January 1, 2025, it will have 90 calendar days after receiving actual or public notice that the company’s creation or registration is effective to file its initial BOI report.

- If your company is created or registered on or after January 1, 2025, it will have 30 calendar days from actual or public notice that its creation or registration is effective to file its initial BOI report.

How Do I Report?

Reporting companies will have to report beneficial ownership and applicant information electronically through FinCEN’s website. The system will provide the filer with confirmation of receipt once a completed report is filed with FinCEN.

What Are the Penalties for Failing to Report Business Owner Information to FinCEN?

Failure to report complete or updated beneficial ownership information to FinCEN, or providing false or fraudulent information may result in civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000.

Senior officers of an entity that fails to file a required report may be held accountable for that failure.

What Do I Do Next?

If your company was created before January 1, 2024, you will have one year to submit the required information via the FinCEN website.

If you register your company with the Secretary of State on or after January 1, 2024, you will have either 30 or 90 days to comply with the reporting requirements, depending on when your entity is formed.

You may also need to revise operating, shareholder, or joint venture agreements to assign responsibility for tracking and reporting beneficial owner information and to require company owners to comply with the reporting obligations.

Your attorney can assist you with meeting your reporting obligations, and review new or existing company agreements for compliance with the Corporate Transparency Act.

Questions about how the Corporate Transparency Act will impact your company? Contact the business attorneys at Hendershot Cowart P.C. for a consultation.